KPMG Saved $59K. The Precedent Will Cost You Millions.

Your biggest client just read the same news you did. They're already doing the math.

Image create by GPT Image 1.5

Your Clients Are About to Ask for a Discount. Here’s How to Get Ready.

TL;DR: KPMG just strong-armed its own auditor into a 14% fee cut by arguing AI makes the work cheaper. Days later, Baker McKenzie laid off 700 people, citing AI. These two events aren’t isolated news stories. They’re the opening shots of a pricing revolution across every services business that charges by the hour. If you run a firm that sells expertise by the clock, you need a pricing strategy for this moment, not next year.

The Week That Changed the Conversation

I had three separate conversations this past Monday morning about the same thing. One was with a European colleague who runs an investment firm. Another was with a group of market services leaders. The third was with the head of a valuation company. All three had seen the same two stories. All three were asking the same question: what happens to our pricing now?

Here’s what set them off.

KPMG, one of the Big Four accounting firms, told its own auditor, Grant Thornton, to cut fees because AI should be making the work faster and cheaper. When Grant Thornton pushed back, KPMG threatened to find a new auditor. It worked. Grant Thornton’s audit fee dropped from $416,000 to $357,000, a 14% reduction. The irony is hard to miss. KPMG is in the exact same business. Every smart KPMG client just got handed the playbook for their next fee negotiation.

Days later, Baker McKenzie, a top-ten global law firm, announced it was cutting roughly 700 positions, about 10% of its staff. The firm’s statement directly mentioned AI as a driver, saying it was “rethinking the ways in which we work, including through our use of AI.” These weren’t attorney positions. They were business professionals across IT, knowledge management, admin, marketing, and design. The functions that keep a firm running.

Two different firms. Two different moves. Same signal: AI is no longer a future problem for services pricing. It’s a current one.

Why This Matters Right Now

The timing here isn’t coincidental. We’re at a tipping point where AI has moved from impressive demos to real work output. AI-enabled associates can now draft NDAs up to 70% faster than their peers working without it. Document review that used to take a team of paralegals weeks can be done in hours. And it’s not just legal. Across accounting, consulting, and advisory services, the same compression is happening.

McKinsey has reported significant headcount reductions over the last couple of years, and separate reporting has described plans/discussions for additional cuts in some non-client-facing areas. Accenture announced 11,000 role reductions tied to AI and automation. Deloitte is restructuring its entire talent architecture, scrapping traditional job titles to reflect a workforce that’s part human, part AI agent. McKinsey’s CEO recently said their fleet of AI agents grew 500% in 18 months to roughly 20,000 agents.

But here’s what really matters for you: nearly 60% of in-house counsel say they’ve seen no noticeable fee reduction from their outside law firms despite knowing those firms are using AI. That gap between “we’re using AI internally” and “we’re passing savings to clients” is closing fast. KPMG just proved that a sophisticated buyer will call your bluff.

The Billable Hour Is Under Siege

For more than half a century, professional services firms have charged by the hour. It was simple. It absorbed uncertainty. And it made firms very wealthy. But the billable hour worked because time was a reasonable stand-in for value. If a task took 10 hours of expert work, charging for 10 hours felt fair.

AI breaks that logic. When a task that took 10 hours now takes two, billing for 10 hours isn’t just questionable. It may be ethically problematic. The American Bar Association’s Model Rule 1.5 requires legal fees to be “reasonable.” Billing a client for 12 hours of discovery work that an AI completed in minutes is exactly the kind of scenario that’s going to draw scrutiny.

And the data tells the story. Profits per lawyer at Am Law 100 firms have climbed 54% since 2019, but billable hours per lawyer are actually declining. Firms are earning more not because lawyers are working more, but because rate increases have outpaced client pushback. That imbalance doesn’t last. It never does.

Think about it this way. The billable hour survived because no external force had the muscle to change it. Clients complained but didn’t act. AI is that external force. KPMG just proved a sophisticated buyer can walk in with a simple argument: you’re using AI, the work is faster, I want a lower price. And it worked.

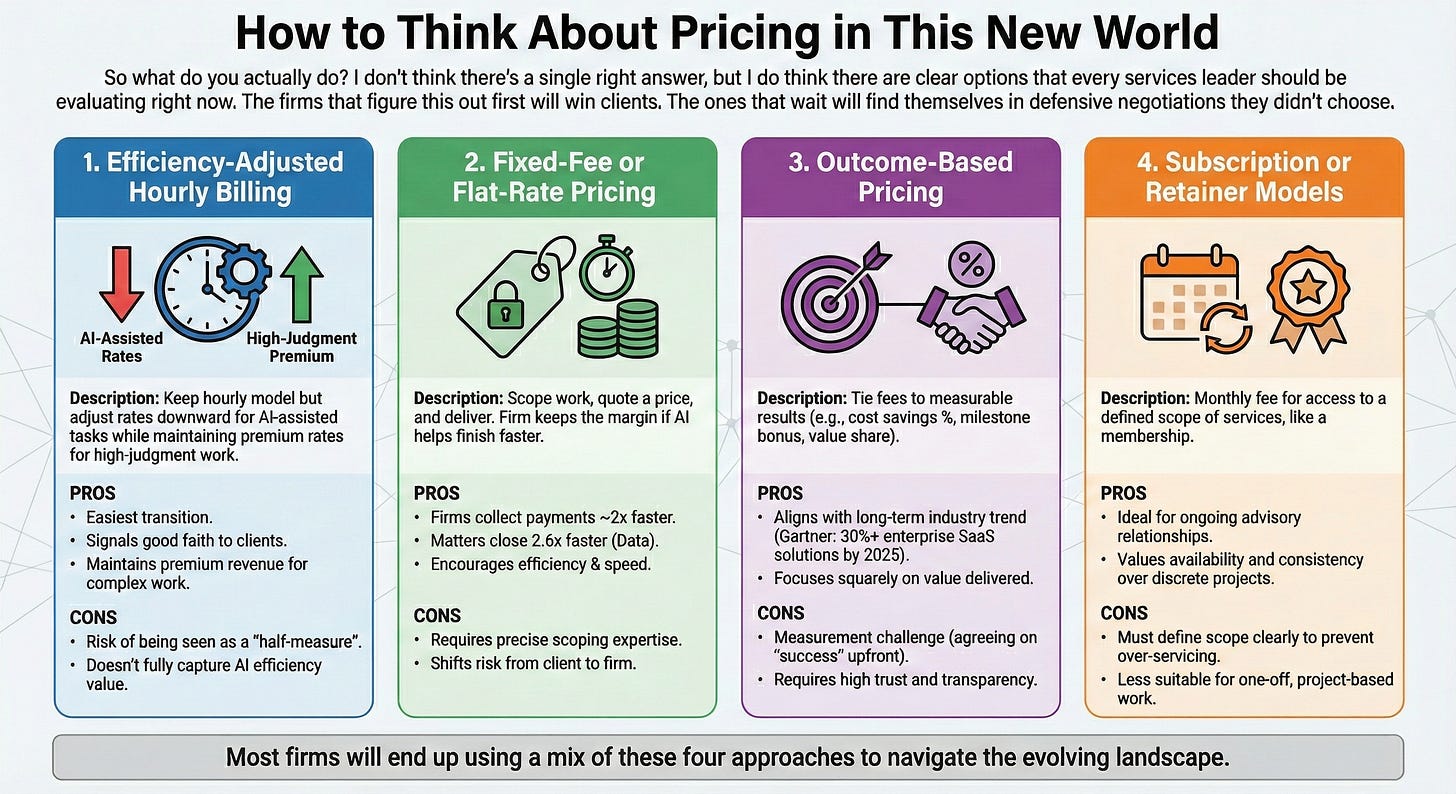

How to Think About Pricing in This New World

So what do you actually do? I don’t think there’s a single right answer, but I do think there are clear options that every services leader should be evaluating right now. The firms that figure this out first will win clients. The ones that wait will find themselves in defensive negotiations they didn’t choose.

Here’s how I’d think about it. There are really four pricing approaches emerging, and most firms will end up using a mix.

The first is efficiency-adjusted hourly billing. You keep the hourly model but adjust rates downward for AI-assisted tasks while maintaining premium rates for high-judgment work. This is the easiest transition. It signals good faith to clients without blowing up your entire revenue model. The risk is that it’s a half-measure, and clients may see it that way.

The second is fixed-fee or flat-rate pricing. You scope the work, quote a price, and deliver. If AI helps you finish faster, you keep the margin. The data here is encouraging: firms using flat fees collect payments nearly twice as fast, and matters close 2.6 times faster. But it requires you to get very good at scoping work, and it shifts the risk from client to firm.

The third is outcome-based pricing. You tie fees to results. A percentage of cost savings delivered. A bonus for hitting specific milestones. A share of the value created. This is where the conversation is heading long term. Gartner projected that by 2025, over 30% of enterprise SaaS solutions would include outcome-based pricing components. Services firms are next. The challenge is measurement, because both sides need to agree on what “success” looks like before the work starts.

The fourth is subscription or retainer models. Clients pay a monthly fee for access to a defined scope of services. Think of it like a membership. This works well for ongoing advisory relationships where the value is availability and consistency rather than discrete projects.

The Tradeoffs Nobody Wants to Talk About

I want to be honest about what’s hard here. Moving away from hourly billing isn’t just a pricing decision. It’s a business model decision that touches compensation, staffing, partner economics, and firm culture.

Partners at most professional services firms are compensated based on revenue generated, which in practice means hours billed and collected. Switch to flat fees and the partner who figured out how to do a deal review in half the time makes twice the margin. That sounds great until you realize it also means fewer hours to spread across associates, which means fewer associates, which means a smaller pipeline of future partners. Baker McKenzie’s 700-person cut is what the early stages of that math look like in practice.

There’s also a real tension between what AI costs to build and what it saves. KPMG itself acknowledged this, saying that while AI creates efficiencies, “developing and operating AI systems can generate additional costs.” Grant Thornton made the same point. The savings aren’t as clean as a simple “AI did it faster” argument suggests. At least not yet.

And there’s the talent question. If you cut the entry-level work that trained your junior people, how do they develop the judgment that makes your senior people valuable? Nobody has solved this yet. But the firms that ignore it will find themselves with a capability gap in five to seven years.

What to Do Monday Morning

Audit your current work against AI capability. Identify which tasks your team performs today that AI can already handle at 70%+ quality. That’s where your pricing pressure will come from first.

Pick one service line and pilot a non-hourly model. Fixed fee, outcome-based, or subscription. Run it for 90 days with a willing client. Measure everything.

Get ahead of client conversations. If you wait for your clients to bring up AI pricing, you’re already playing defense. Bring it up first. Show them you’re thinking about value, not just protecting revenue.

Redesign your junior talent pipeline. If AI absorbs the repetitive work, create new ways for early-career professionals to build judgment. Shadowing, case-based learning, mentorship. Don’t just hope they’ll figure it out.

Model the economics. Run the numbers on what your firm looks like at 80% of current billable hours but with AI-augmented output. The answer might surprise you. Many firms will actually be more profitable, not less, if they move first.

The Bottom Line

KPMG saved $59,000 on a single audit fee cut. That’s pocket change for a Big Four firm. But the precedent it set is worth billions across the entire services economy. Every client in every industry now has permission to ask the same question: if you’re using AI, why isn’t my bill going down?

The firms that answer that question on their own terms will thrive. The ones that wait for clients to force the conversation won’t like how it ends.

Why I write these articles:

I write these pieces because senior leaders don’t need another AI tool ranking. They need someone who can look at how work actually moves through their organization and say: here’s where AI belongs, here’s where your team and current tools should still lead, and here’s how to keep all of it safe and compliant.

In this article, we looked at the gap between firms using AI internally and clients who haven’t seen a dollar of savings from it. KPMG closed that gap in a single negotiation, and the playbook is now public. The pricing conversation is no longer optional. But the firms that initiate it on their own terms will have far more control over where it lands than the ones who wait for a client to force it.

If you want help sorting this out:

Reply to this or email me at steve@intelligencebyintent.com. Tell me which service lines are most exposed to pricing pressure and where your current fee model feels vulnerable. I’ll tell you what I’d test first, which pricing structure fits your client mix, and whether it makes sense for us to go further than that first conversation.

Not ready to talk yet?

Subscribe to my daily newsletter at smithstephen.com. I publish short, practical takes on AI for business leaders who need signal, not noise.