Territory Planning in Weeks, Not Quarters: The AI Playbook Sales Leaders Are Using to Skip the Politics

The practical playbook for cutting territory planning from 90 days to 14 days while improving balance, protecting key relationships, and reducing weekly travel time.

AI Territory Planning Without the Politics

TL;DR: You can rebalance sales territories in weeks, not quarters, by letting AI account for real constraints, such as drive time, ICP potential, rep capacity, and protected relationships. It provides neutral scenarios, clear trade-offs, and an audit trail that you can defend. Below is a simple playbook, along with a real client example that you can use as a reference.

Why this matters now

You’ve seen it. Maps that reflect old arguments more than current demand. A few reps are drowning while others chase deals two time zones away. Pipeline shape suffers, morale dips, and you kick the reset to next quarter.

AI changes the tempo. Feed it your data, set the rules, and it returns side-by-side territory options you can compare. It doesn’t care who asked first or who’s been here longest. It just scores outcomes against the goals you pick and shows you the cost of each constraint. No drama. Just choices.

How AI “sees” territories

Think about the problem from a handful of angles.

Start with geography and time. Not just state lines. Real drive time, flight patterns, and time zones. A plan that trims six hours of weekly travel per rep is money back in the quarter.

Layer in potential and revenue. Where are ICP-fit companies clustered? Which states throw off the next 12 months of expansion? Blend firmographics, past win rates, and product fit to balance quality, not just quantity.

Add capacity and skills. How many quality touches can each rep make? Who excels in med-tech versus fintech? Spreading a specialist too thin torpedoes both ramps.

Then look at pipeline balance and service coverage. Can SEs and CSMs support the shape you’re creating? Are you overassigning new logo hunting to a rep with a heavy renewals focus? The model can highlight those mismatches before they cost you a quarter.

How to steer the model

You don’t surrender judgment. You encode it.

Hard constraints. Lock specific states or named accounts to a rep for relationship or expertise reasons. Keep state boundaries intact if you want continuity.

Travel rules. Cap weekly drive hours, restrict time zones, or limit each rep to one flight market.

Fairness targets. Balance by ICP-weighted opportunity, revenue, new logo count, or workload. Pick one primary target.

Skills bias. Tag reps by product or vertical and weight assignments toward their strengths.

Change budget. Set a ceiling on the number of accounts that can move this cycle so you don’t burn trust by chasing a perfect balance.

Ask for multiple scenarios: one that prioritizes balance, one that minimizes disruption, one that favors clean borders. Score each on the same four things and decide like adults.

Real-world example: from five territories to three

We had to consolidate five client territories down to three without damaging existing relationships or creating coast-to-coast routes. The brief was tight: two specific states had to stay with a particular AE because of deep ties and domain expertise; we wanted state-level continuity for simple routing; and we needed each territory to carry a comparable load of ICP-qualified opportunities.

What I fed the model. I exported the current state-level map, our ICP model with company counts and estimated revenue potential by state, and a list of active accounts likely to move. I flagged the two protected states and identified active late-stage deals we did not want to disrupt. Then I loaded everything into ChatGPT 5-thinking (heavy).

The guardrails. Build exactly three territories at the state level. Lock the two relationship states to the named AE. Don’t split states. Keep the number of reassigned accounts under a fixed cap. Balance territories on an ICP-weighted opportunity score rather than raw logo count.

The request. “Generate three options that minimize variance in ICP-weighted opportunity across territories under these constraints. For each option, return the balance score, continuity check, count of protected relationships honored, and percent of accounts moved.”

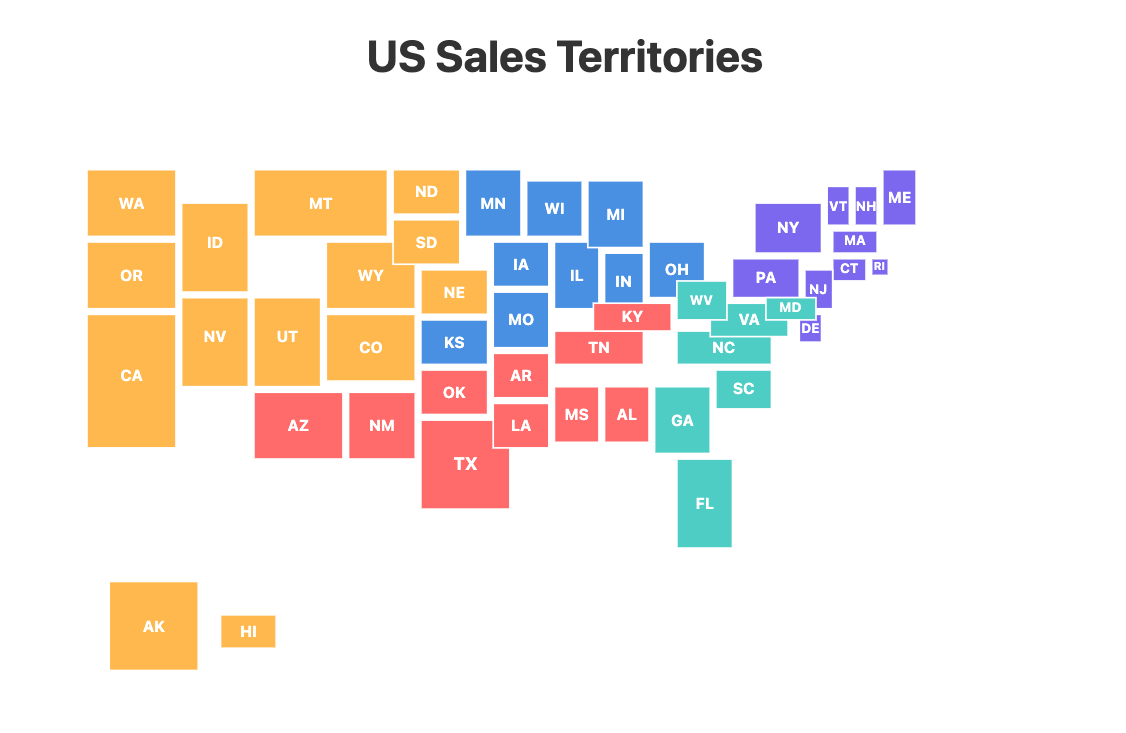

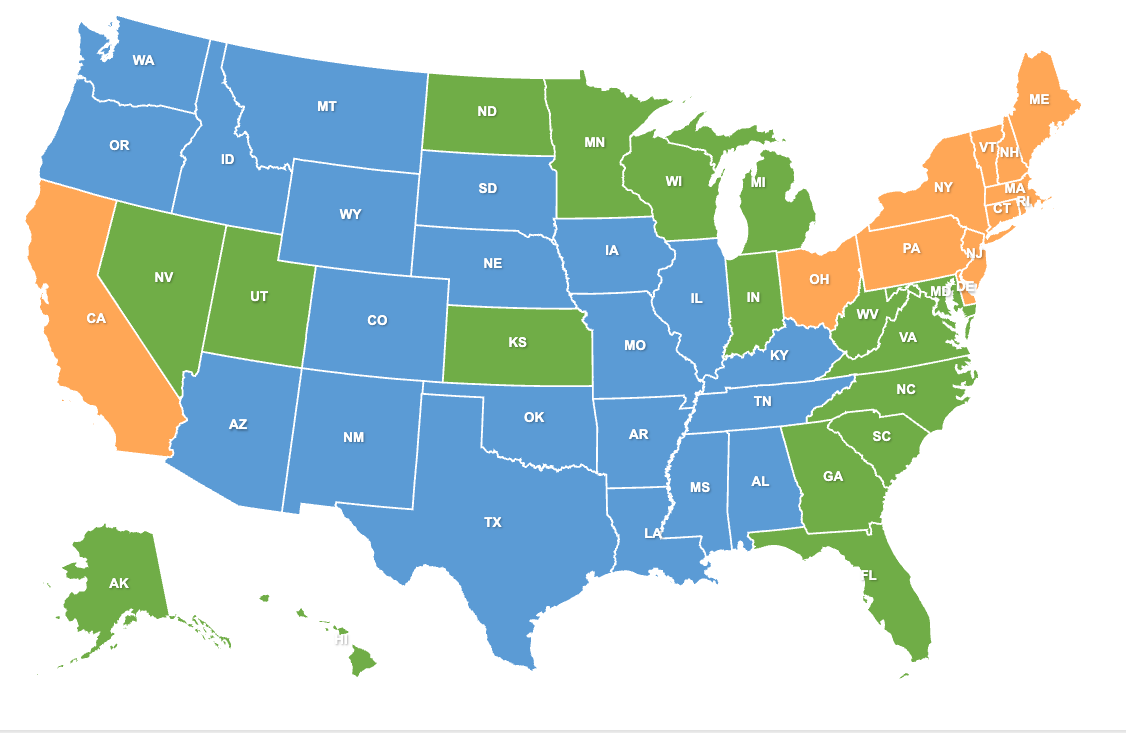

What came back. Three maps:

• A near-perfect balance that required significant reassignment.

• A low-disruption plan that preserved most relationships but left a wider spread.

• A middle option that kept West–Central–East continuity, honored both protected states, and tightened the spread without blowing the change budget.

I overlaid our active pipeline on each, reviewed the account-move lists, and accepted the middle option, making two small swaps suggested by the model as ties.

What the scorecard showed. ICP-weighted opportunity landed within roughly a 10 to 12 percent band across the three territories, down from a much wider spread. We held reassignment to about 15 to 20 percent of accounts, with late-stage deals largely untouched. Travel patterns simplified as state clusters were consolidated, which should free several hours per rep each week. The model also produced an audit log per move: the constraint it satisfied, the balance gain achieved, and the projected impact on the active pipeline. That transparency is what keeps the room calm.

Three lessons stood out. First, balance value over volume. Two regions with the same logo count can hide very different upside; weighting by ICP closes that gap without a messy reshuffle. Second, treat hard locks as first-class inputs. If a state can’t move, say so up front and save everyone time. Third, set a change budget before you start. It forces discipline and keeps you from trading long-term goodwill for a minor statistical win.

Add your screenshots here. For clarity, caption them simply: “Before: five territories, wide ICP spread” and “After: three contiguous territories, ICP within ~10–12 percent band.”

Risks and tradeoffs

This isn’t magic. Bad inputs still produce bad maps. If rep notes are thin, product tags are noisy, or account hierarchies are wrong, clean the top cohort before you run anything. Local facts matter too. A route that appears efficient in a spreadsheet may actually be hindered by a mountain pass that is closed for half the winter. Pull that context into review.

Change fatigue is real. If you swing too far in one pass, you’ll dent trust and slow adoption. Explain the goal in plain English, publish the scorecard you used, and backstop handoffs with clear owners and dates. And ensure that incentives align with the plan. If compensation pays only on bookings and ignores churn, no amount of clever mapping will change the behavior.

What to do on Monday morning

Pick one primary goal. Example: cut average weekly travel time 30 percent or bring ICP-weighted opportunity within a 15 percent band.

Assemble the data. State or ZIP, accounts, ICP scores, booked revenue, pipeline by stage, rep capacity, and skills tags. Clean the top 20 percent by revenue impact.

Write the rules. List your hard locks, travel limits, fairness target, and a change budget. Treat these as non-negotiable.

Generate three scenarios and score them. Use the same four criteria every time: balance, continuity, relationship preservation, and percent moved. Blend if needed.

Pilot, then publish. Test one region for 30 days, gather feedback, finalize the map, and share a one-page “why this plan” note with the scorecard attached.

Bottom line: set the rules, let the math propose options, then choose the plan that best serves the goal. You’ll spend less time arguing lines on a map and more time winning the accounts that matter.

Business leaders are drowning in AI hype but starving for answers about what actually works for their companies. We translate AI complexity into clear, business-specific strategies with proven ROI, so you know exactly what to implement, how to train your team, and what results to expect.

Contact: steve@intelligencebyintent.com